Are today’s real estate interest rates a dealbreaker for young dentists? Not necessarily, provided you’re informed—but 2024 is right around the corner, and smarter deals may be just ahead.

BY JARRON TAWZER, DMD

YOU’RE SURELY aware that the Federal Reserve has been raising interest rates for the last year or so. How, though, do rate hikes affect residential, commercial and investment real estate? Should you postpone or otherwise rethink your plan to invest?

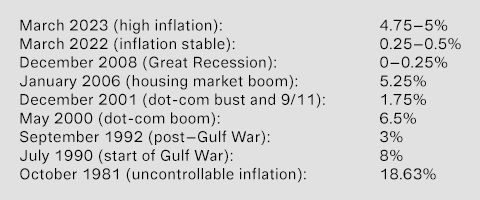

Unlike the price of food in your grocery store or fuel at the gas station, interest rates are not driven by supply and demand. In simple terms, the Federal Reserve raises interest rates when the economy is overheating or there is abnormal inflation. When the economy looks weak or there’s high unemployment, the Fed lowers rates. This has resulted in some significant fluctuations over time, as illustrated below.

As you can see, even sharp upticks are followed (eventually) by rate drops. As uncomfortable as it is to live through periods like this, we’ve been on similar rollercoasters before. That’s why it’s important to study previous trends and cycles of both high and low interest rates with the events that follow both. (If nothing else, we can take comfort in the fact that we’re unlikely to see a repeat of 1981.)

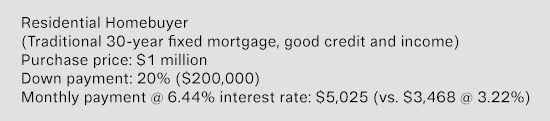

So how do these rates affect real estate—and your ability to buy? Residental real estate rates are not set by the Fed but typically trend 1 to 3 percent higher than its determined rate. In January 2023, the national average interest rate for a 30-year mortgage was approximately 6.44 percent. In January 2022, we saw an average of 3.22 percent on the same loan. Let’s put this into perspective for what it means to the bottom line. In the example below, buying the same home in January 2022 compared to January 2023 would have saved the buyer $1,557 a month.

Interest rates on commercial property loans tend to be higher than those on residential loans—typically 0.5 to 1 percent higher than the 30-year home rate—and require a 20 to 25 percent down payment. Rates for multifamily properties (fourplex, apartments, condos) tend to follow and mirror more closely those of commercial real estate.

What does all this mean? Whether you’re looking to buy a home or investment property, or move your practice to some new bougie area of town, consider current rates. According to the Mortgage Bankers Association’s seasonally adjusted index as of this writing, mortgage demand is down 44 percent year over year and refinancing demand is down 84 percent, both of which are at a 28-year low.

Ironically, average housing prices are higher than a year ago. The same could be said for both investment and commercial properties.

However, it’s obvious that high rates, high demand and high prices cannot coexist for too long. We’re looking at a recipe for decline. I expect 2023 to be a poor year overall for housing, investment and commercial properties while the industry deals with the correction that is coming. As seen in countless years past, I’m also optimistic for 2024 and hope for a real estate market recovery next year.

JARRON TAWZER, DMD graduated from Oregon Health & Science University. He currently practices cosmetic and implant dentistry in Logan, Utah, while also indulging his entrepreneurial side. He is the owner of several businesses and many real estate developments and acquisitions. Dr. Tawzer also writes and advises on real estate investment. Contact him at jarrontawzer@yahoo.com.