RETIREMENT INVESTING takes two things: confidence and cash. Luckily, the vast majority of participants in Incisal Edge’s 2025-26 Dentist Survey possess both. Over 90 percent say they’re very or somewhat confident they’ll reach relatively aggressive retirement savings goals of up to $5 million or more—an overwhelmingly positive result. Meanwhile, 5 percent say their career hasn’t been sufficiently financially rewarding, reminding us there’s still work to do within this community to help all dentists achieve their own vision of success.

Financial freedom in retirement often hinges on eliminating big debts, which can drain even sizable nest eggs. By mid-career, many respondents have paid off major obligations—like practices or vacation homes—or expect to soon. Encouragingly, nearly half say they’re not at all concerned about debt, including younger dentists who likely still carry mortgages, practice loans and residual student debt.

If you’re worried about spending your golden years in a van down by the river, well, our results indicate that you can relax—provided you’re doing at least some planning and strategizing. Not everyone is. While confidence and cash are essential, good advice matters too. That’s why we were taken slightly aback to discover that about 18 percent of respondents say they aren’t working with any financial advisors whotsoever. Still, most dentists remain in control, and those planning to work into retirement say it’ll be by choice, not necessity.

Read on for data snapshots and expert analysis from the Incisal Edge team and Dan Wicker, CPA, one of dentistry’s most trusted voices on financial wellness. Wicker is managing partner at Cain Watters & Associates, which has specialized in financial education and services for dentists since 1984, serving more than 3,400 clients in 50 states.

Since joining the firm in 1997, Wicker has focused exclusively on dentists’ unique needs, sharing insights at the firm’s Practice Transition Seminar, dental society meetings, study clubs and events hosted by Incisal Edge and our publisher, Benco Dental. His team helped design this survey in collaboration with Incisal Edge. With that foundation, let’s dive into what dentists are doing and how you can refine your own strategy.

Methodology

Participants were invited primarily via email using contact information from Benco Dental data to ensure that verified email addresses would receive an invitation. Special invitations were emailed to a randomly selected portion of former Incisal Edge 40 Under 40 honorees, representing less than 1 percent of the total number of invitations sent. Participants were also invited via Benco Dental social media channels, and in all cases, poor-quality responses were filtered out using AI analysis confirmed by human review of flagged responses.

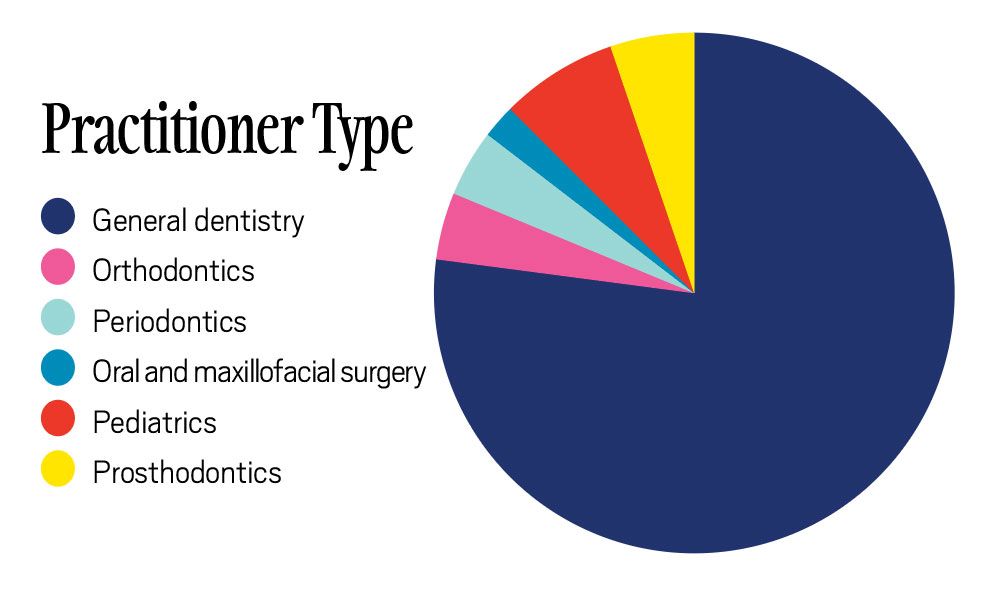

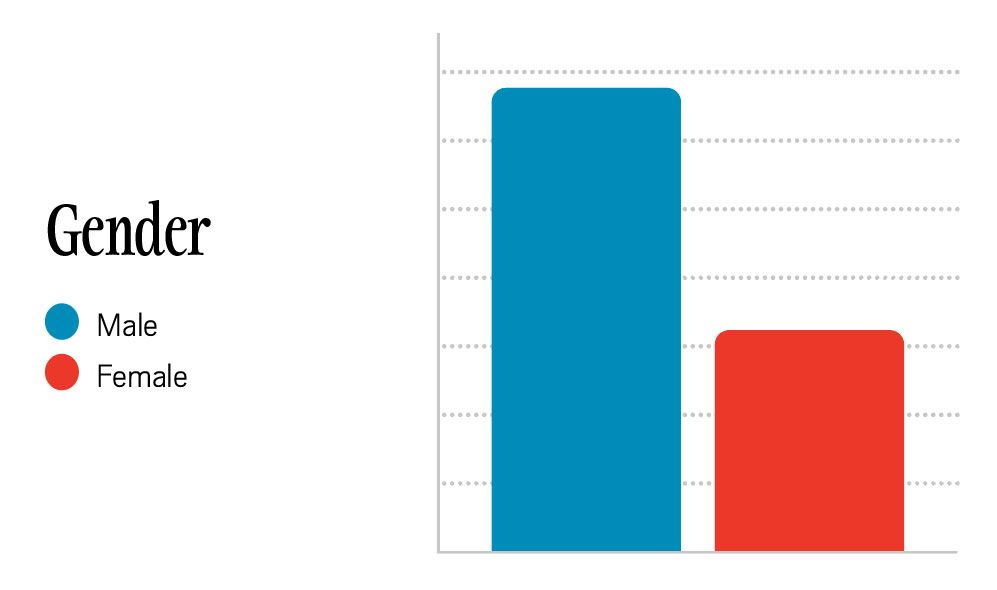

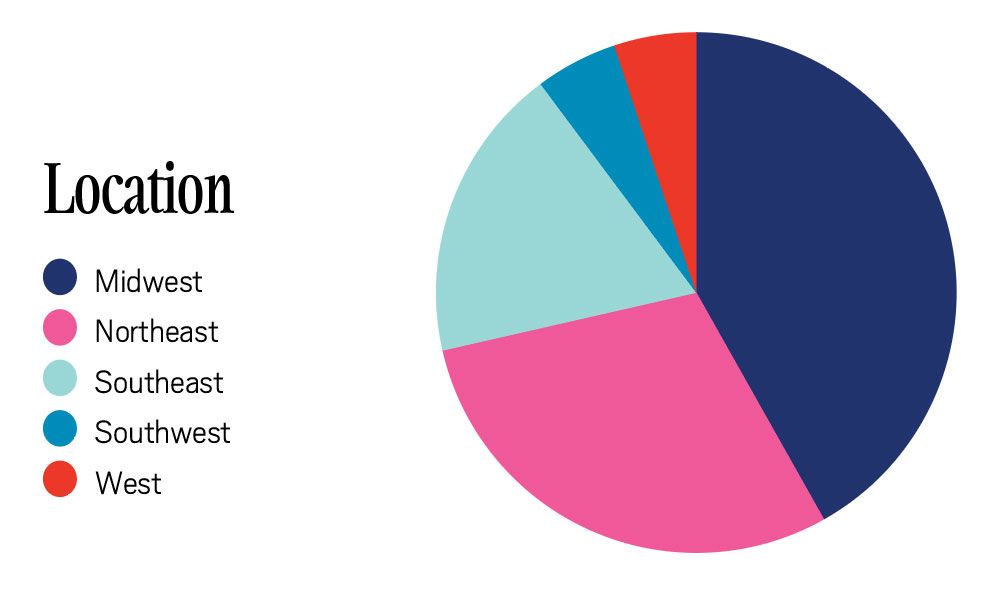

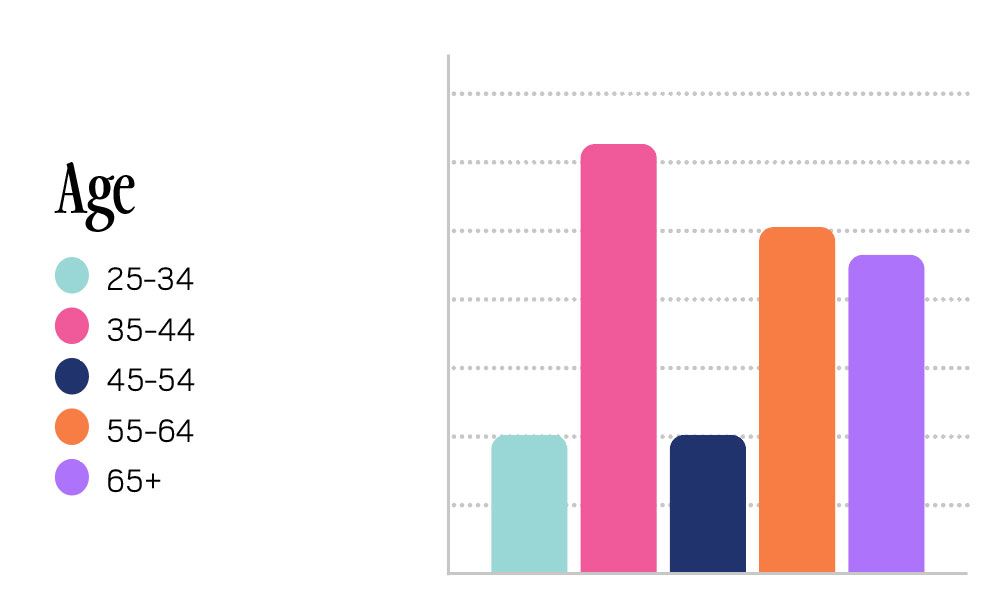

The Participants

The Results

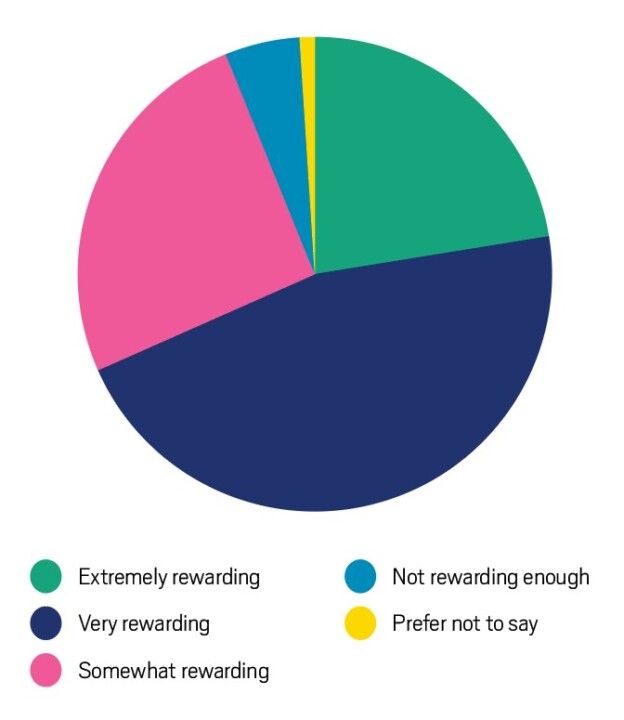

1. So far, how financially rewarding has your dental career been?

INCISAL EDGE SAYS: Plenty of professions offer middling career satisfaction and dicey retirement prospects, but our survey says dentistry isn’t one of them. Most respondents described their career as extremely or very rewarding. Still, rising education costs and a changing business landscape may be eroding some confidence: About one in four expressed at least some level of disappointment with dentistry’s financial upside, while a small but notable group (about 5%) said it hasn’t been rewarding enough. Interestingly, while the least satisfied skewed younger and tended to be associates rather than practice owners, those who found dentistry only somewhat rewarding were largely practice owners.

DAN WICKER SAYS: Through our 41 years of working with dental clients, we’ve seen the seasons of life that come with being a doctor. When you’re just starting out, it’s not uncommon to have significant student loan debt, a new mortgage and car loan, plus a practice buy-in loan (or startup loan). Add in trying to grow your clinical skills, running a business, building a family and maintaining some sense of a social life, and no wonder financial and emotional stress is high. As you continue to grow in your career, however, we see investment assets increase, debt decrease, confidence improve and stress level off. From a financial perspective, understanding what’s important (and when) is crucial to relieving some of this stress early and getting on the right track. Having an advisor who understands your career timeline and will hold you accountable is crucial.

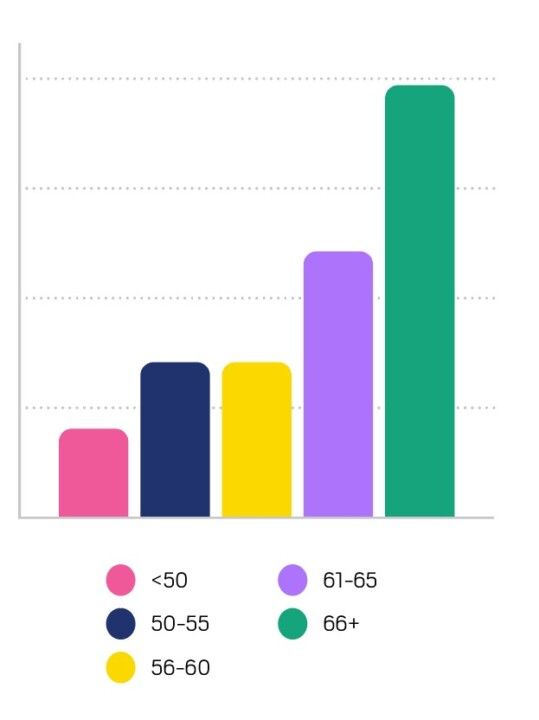

2. At what age do you expect to retire?

INCISAL EDGE SAYS: There’s a lot of encouraging news here beyond the raw numbers. While most respondents expect to work well into retirement age, they say it’s by choice—not necessity. At the other end of the spectrum, a significant share plan to retire in their fifties, and another approximately 8% aim to step away before 50. The takeaway? With thoughtful planning, dentistry still offers ample freedom, earning power and flexibility for whatever career timeline one envisions.

DAN WICKER SAYS: When planning retirement goals for our clients, we start by asking the simple question: “What does retirement look like for you?” From there, we work backward to create annual savings targets and investment strategies that fit that long-term plan. Our goal as a firm, though, isn’t just retirement but financial freedom. It’s great to have a plan for when you want to retire, but it’s also wise to build a financial plan for security in case you don’t get to decide when you retire. While most clients aim for freedom at 55 to 60 and retirement at 62 to 65, we have unfortunately seen dozens of clients forced into retirement earlier. That’s why planning for both the expected and the unexpected is essential.

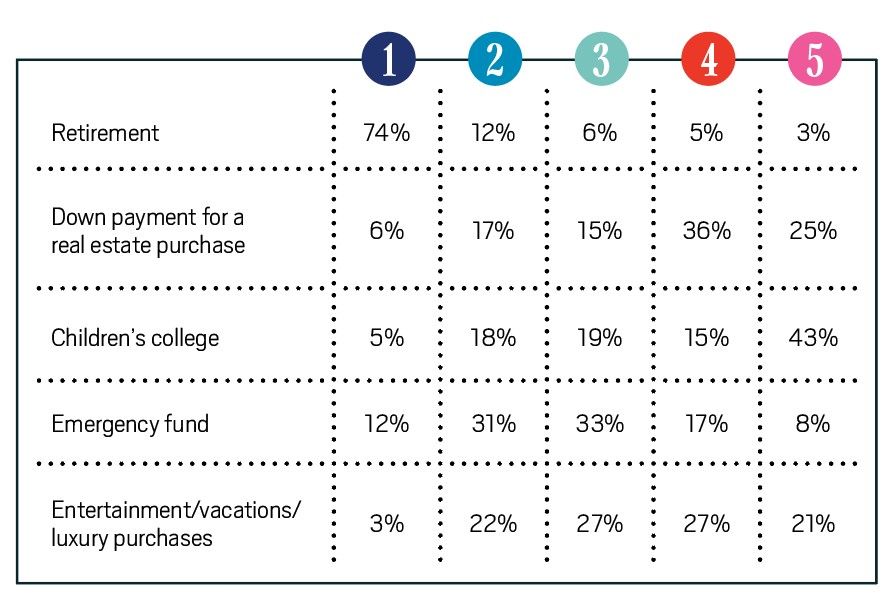

3. What are your savings priorities in order of importance?

INCISAL EDGE SAYS: We asked participants to rank their savings priorities from 1 through 5, and retirement stood at the top across all age groups for 74% of our respondents. That’s a strong sign that dentists are indeed planning ahead—and have the means to do so, even early in their career. Understandably, younger respondents (ages 25 to 34) are more likely to also focus on building an emergency fund or saving for a real estate down payment.

DAN WICKER SAYS: The data in this report is promising and aligns closely with what we see in new clients each year. What’s missing, though, is that many doctors are hyperfocused on debt paydown first, and actual saving takes a back seat. Most understand the importance of saving for retirement yet have not been educated on when to pay down debt versus save for retirement. For clients, we break down common assumptions and help build a balance of debt paydown and retirement savings. This helps them reach financial freedom at an earlier age.

I would like to retire sooner rather than later. I can make more money, but I cannot make more time.”

—General dentist, Northeast, name withheld by request

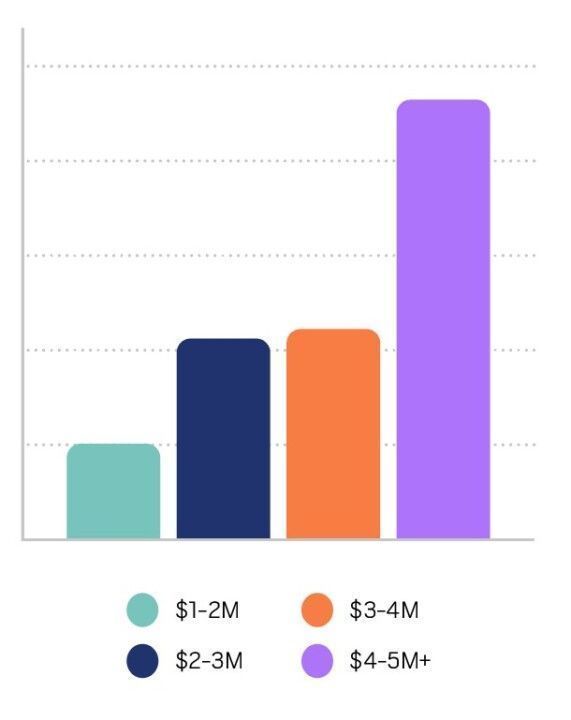

4. What is your target for retirement savings?

INCISAL EDGE SAYS: This is interesting. Most respondents set high retirement savings targets consistent with other white-collar high earners, but older demographics show a more even distribution across targets as low as $1-2 million. This may be generational for some, reflecting their having paid off major expenses (like mortgages or vacation homes) earlier in life, reducing their retirement income needs, and perhaps many plan to continue working part-time. Younger dentists, by contrast, appear to anticipate higher future costs and are aiming for much larger nest eggs to cover expenses decades down the road.

DAN WICKER SAYS: At CWA we use a “work backward” strategy that starts with how much a client wishes to spend per month in retirement. Using that figure, coupled with conservative assumptions on retirement projections, we set annual savings goals to keep clients on track for financial freedom. One thing we often see is younger clients with aspirations of fully stepping away from dentistry early, but as they age, they decide they want to work longer once the early career financial and emotional stress evaporates.

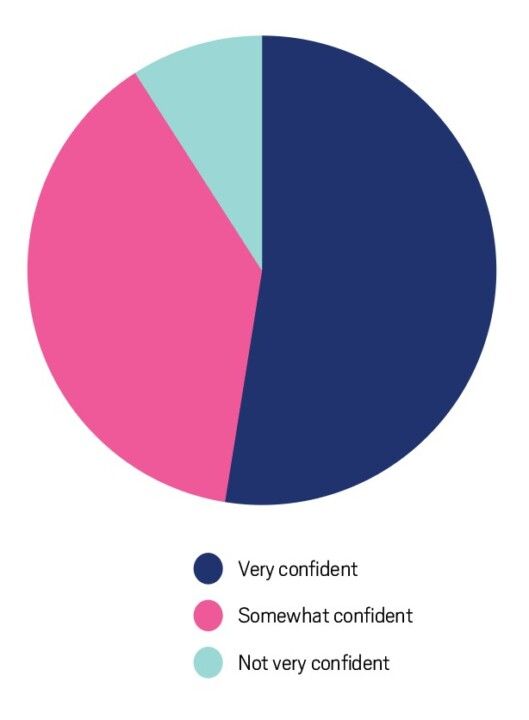

5. How confident are you that you will reach your retirement savings target?

INCISAL EDGE SAYS: Reflecting the general positivity on previous questions, retirement confidence is strong across all age groups. Predictably, it’s highest among those aged 55 to 64, who have been saving longest and are nearest the finish line. Still, most respondents in every age bracket reported feeling very or somewhat confident about their retirement plans. Despite some income differences between specialties, dentists of every type reported high retirement confidence, with none standing out as significantly less so.

DAN WICKER SAYS: It’s great to see a high level of confidence across all demographics. Regardless of your current income, there is a plan that meets your needs. We illustrate this to our clients through the concept of “1:1, 2:1, 3:1.” This idea is centered around taking advantage of compounding returns over time to generate assets that work for you—not the other way around. While this principle applies universally, the specific assumptions and goals should be customized to meet your needs and savings abilities.

Thank you to my father for emphasizing devoting 10 percent of my paycheck to savings every time.”

—Dr. Sable Muntean, St. Louis

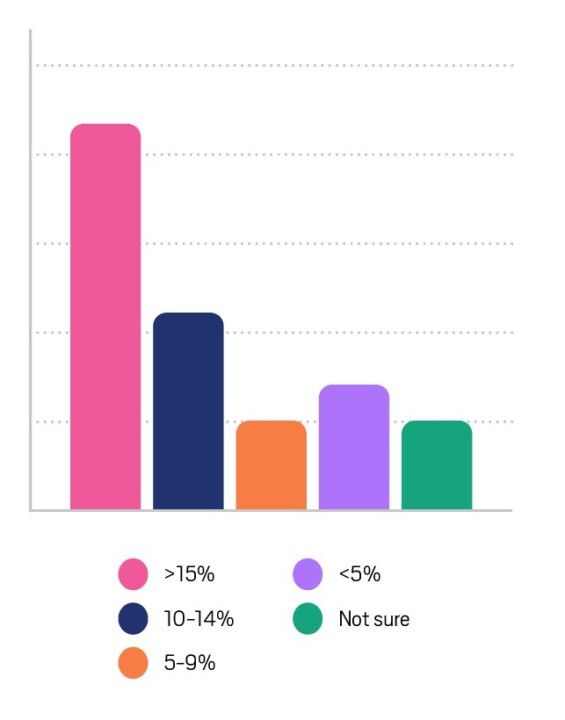

6. How much of your current income do you defer for retirement savings?

INCISAL EDGE SAYS: The majority of our respondents are saving suitably aggressively (at least 10% of their income or more), and about 43% of all respondents are saving 15% or more. Older demographics are more likely to defer a higher percentage, but even dentists as young as 35 to 44 show a tendency to defer 15% or more. Worryingly, however, a small but consistent number of dentists across all age groups aren’t sure how much they’re saving.

DAN WICKER SAYS: To understand how much you’re saving, you must first understand your actual income. We often see confusion on truly understanding income because of complicated tax situations, complex entity structures and general lack of education on an income statement. Once you understand your income levels, it is much easier to set savings goals as a percentage of that income. At a high level, we recommend around 50% of your income be used for necessities and enjoyment, 30% for taxes and 20% for savings.

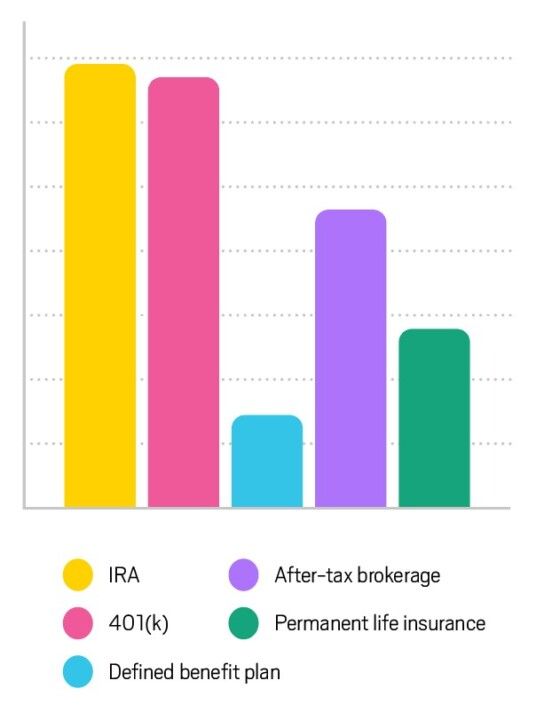

7. To what types of retirement accounts are you currently contributing?

INCISAL EDGE SAYS: While most dentists rely on traditional tax-advantaged vehicles for retirement savings, the use of after-tax brokerage accounts and permanent life insurance suggest a level of diversification that typically reflects the advice of a financial planner or accountant.

DAN WICKER SAYS: At CWA, we believe everyone should first take advantage of retirement saving opportunities that also reduce your taxes. Once that has been maximized, only then do we supplement with after-tax savings. A good target for after-tax brokerage accounts is $250,000 to $500,000 depending on the financial plan. Next, consider a cash balance plan and permanent life insurance as next steps.

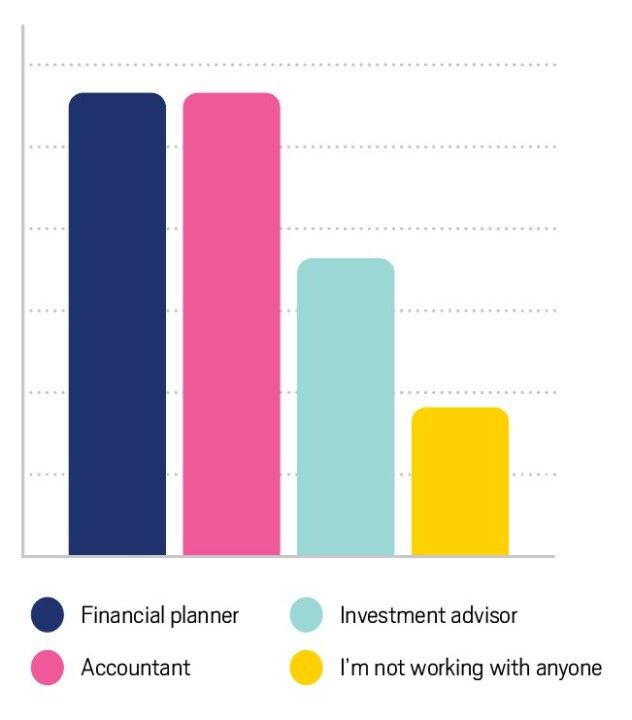

8. Which professionals do you leverage to help you reach your financial goals?

INCISAL EDGE SAYS: About half of respondents rely on a combination of financial professionals, most often an accountant and financial planner (25%), followed by a team that includes an accountant, planner and investment advisor (16.3%). Over 18%, however, aren’t working with anyone. Surprisingly, almost 80% of those who reported going it alone are also full or partial practice owners and not associates relying on an employer’s retirement plan, as we would have expected.

DAN WICKER SAYS: I often find that doctors work with multiple advisors: a financial advisor for investments, a CPA for taxes, an attorney for structuring and a practice consultant for increasing cash flow. The problem is that these advisors rarely coordinate to ensure they’re rowing in the same direction. This lack of alignment can create invisible friction in your plan without you even realizing it. At CWA, we manage taxes, bookkeeping, financial and investment planning, practice transitions and structuring to make sure that all aspects of your practice are in alignment and working toward a common, efficient goal. Whether you partner with CWA or not, make sure your advisors communicate and collaborate to support your financial success.

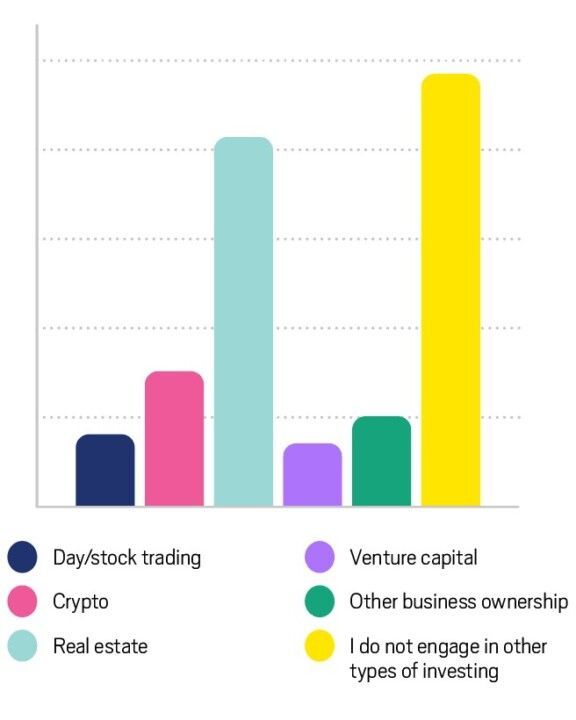

9. What other types of investing contribute to your retirement?

INCISAL EDGE SAYS: Nearly half of respondents don’t invest outside their practice income—a trend most common among owners ages 55 to 64 (about 14%) and 65-plus (about 13%). Younger dentists also show limited diversification, perhaps preferring to invest in themselves at their early career stages. Among alternative investments, real estate leads the way, especially for mid-career owners aged 35 to 44. Younger owners and associates are more likely to dabble in crypto and day trading, while venture capital and other nondental investments attract a smaller but broader demographic mix. Unsurprisingly, semi-retired dentists are least active in alternative investing, likely doing so more for fun than out of necessity.

DAN WICKER SAYS: There’s no way to sugarcoat it: Building a successful investment strategy is complex. Everyone has an opinion on the right way even though there is no single proven path. We believe in two core philosophies of investing, which can work for everyone striving to meet their long-term financial goals. We call the first one “The Five Pillars of Investing.” The pillars are Asset Allocation, Diversification, Rebalancing, Goal-Based Investing and Maintaining Low Fees. Following these pillars and a financial plan help you avoid getting caught up in the noise. The other philosophy is “Investing with a Purpose,” so we understand not only the goals of our clients, but also risk tolerance, age, income and future needs. This allows our advisors to help develop a plan that includes investments in both the public and private markets.

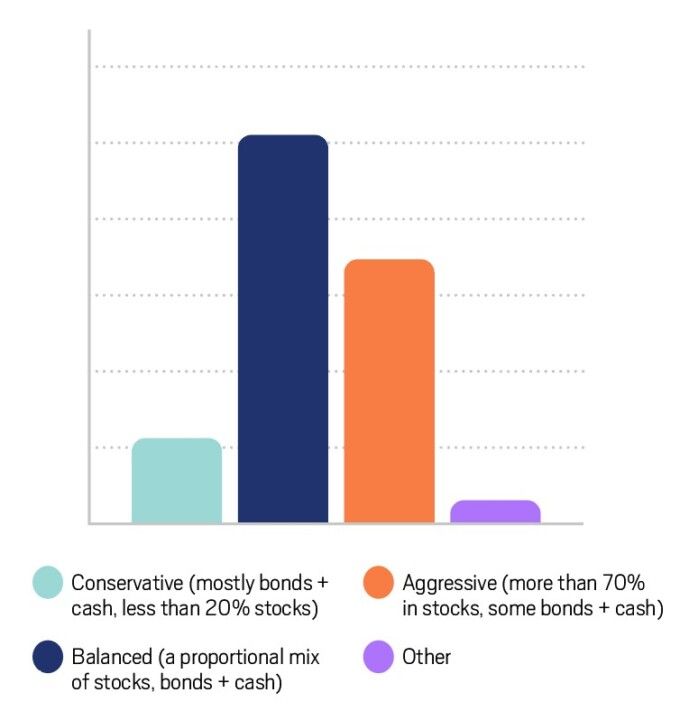

10. How would you describe your retirement savings risk tolerance?

INCISAL EDGE SAYS: Naturally, risk tolerance strongly influences investment behavior. Over 60% of respondents describe their approach as conservative or balanced, which aligns with responses to the previous question and reveals that many limit investing to their practices or retirement accounts like 401(k)s and IRAs. Those with more aggressive risk profiles are far more likely to branch into real estate, crypto and other ventures, while conservative investors tend to avoid these options entirely.

DAN WICKER SAYS: The results of this survey are promising and align with how we advise our clients. History shows the only way to ensure you can meet long-term investment goals is through diversification and asset allocation. That doesn’t mean you can’t have portions of your portfolio that are invested aggressively, or even in speculative investments like crypto. It just means you need to set an appropriate asset allocation across all investments and regularly rebalance your portfolio over time to make sure this doesn’t become too aggressive.

I think dentistry in America is a scam. A dental office is so expensive to run and our student loans are so high.”

—Prosthodontist, Northeast, name withheld by request

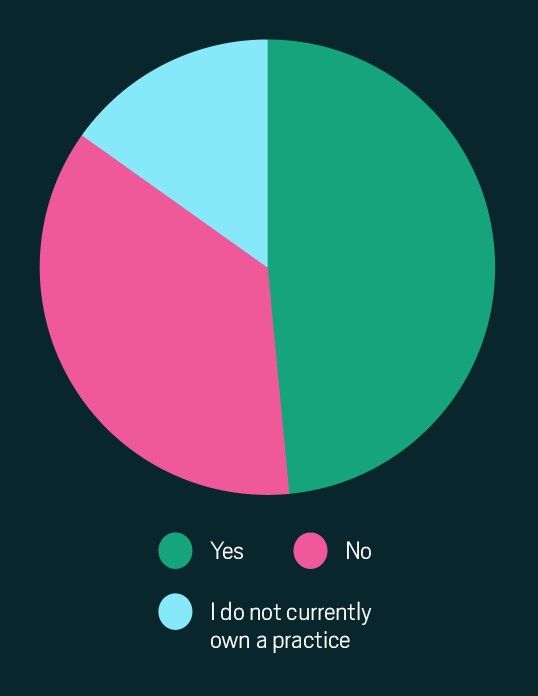

11. Are you counting on the sale of your practice to help fund your retirement?

INCISAL EDGE SAYS: Around 15% of respondents don’t own a practice, but the rest do. A few decades ago, many of them would have relied on a practice sale to fund retirement, but not anymore. Nearly 37% aren’t counting on it, and over 30% of that group is under age 44. This suggests their earnings and investments feel sufficient to power their savings goals, with a practice sale seen as icing on the cake.

DAN WICKER SAYS: While a practice sale should not be your whole plan, having a plan for the transition is crucial. Your practice is one of your most valuable assets and can drastically change your long-term financial plan. Typically, when we run retirement projections, we run them with and without a sale of the practice factored in. That said, as you approach retirement, you must have a plan for how to transition your practice. The sale of your practice should be viewed as an important part of your retirement plan but should not negate the importance of starting your financial plan early in your career.

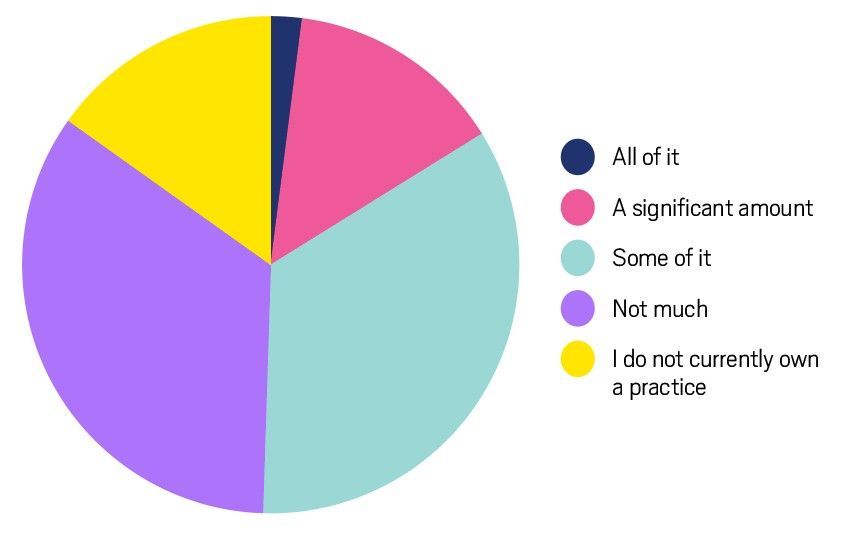

12. What percentage of your retirement savings is currently tied up in your practice’s value and/or real estate?

INCISAL EDGE SAYS: We avoided asking for specific dollar figures and instead focused on how much practice value factors into retirement plans. Contrary to the old days, only about 17% of respondents say all or a significant amount of their retirement savings is tied to their practice’s eventual sale price. About 35% say only some of their practice’s values are a necessary part of their retirement mix, and another 35% answered “not much.”

DAN WICKER SAYS: These responses match what we recommend. Our average client’s plan is built with 20% or less in their practice value. Start early with savings, and a solid financial plan allows for better decisions on when and how to transition for maximum retirement value. We’re also seeing more clients wishing to expand beyond one or two locations, so we see a higher percentage of client plans in illiquid assets such as their practice due to reinvesting in it. This can benefit you down the road, but we always caution against this being your strongest asset and only option for retirement.

13. What is your primary financial concern?

INCISAL EDGE SAYS: The good news: Dentists aren’t worried about the cost of their kids’ college educations. The bad news: They have anxieties nonetheless. While debt isn’t a major concern for most, it’s still on their minds—and saving for retirement tops all worries. (Those who answered “other” specified concerns about passing their practices onto their children, finding ways to generate passive income and curbing their spending habits in favor of saving more. Two participants stated they had no financial concerns—more power to them, we say.) A follow-up question on secondary concerns showed similar priorities, just differently ordered.

DAN WICKER SAYS: Cash flow is king! Simply put, if you maximize your cash flow, you also maximize your options for using it. This allows your plan to ebb and flow over time so you’re able to focus on certain aspects, at times when it is most important. If you ignore or don’t prioritize cash flow, you run the risk of not having options when you need them. Regardless of your career or life season, maintaining positive cash flow is paramount.

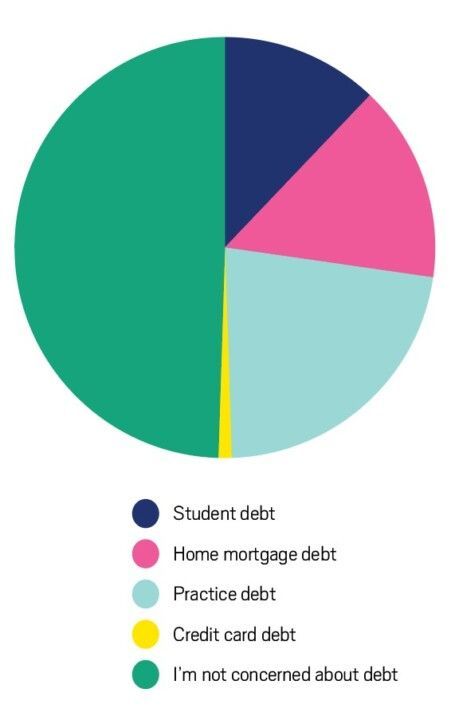

14. What is your primary concern regarding debt?

INCISAL EDGE SAYS: While fewer than 17% of respondents cited debt as a major concern earlier, and nearly half responded here that they’re not concerned at all, there’s no question it affects retirement savings. Digging deeper, we found that practice debt tops all other forms for around 22%. Surprisingly, student debt was a concern for only around 12% of respondents—an interesting result considering the rising cost of dental school. Nearly 92% of those citing student debt concerns were between 25 and 44 years old and nearly 42% were ages 25 to 34. It would seem that worries over student debt subside over time once dentists graduate and increase their earnings. As a whole, debt seems like a manageable and acceptable nuisance for most dentists.

DAN WICKER SAYS: Debt is inevitable for self-employed business owners; you can’t build a dental practice without leveraging your growth and debt. However, debt decisions should align with goals and a plan that drives growth, efficiency and increased profitability. Early on, focus on “good debt” that supports business growth while eliminating or managing nondeductible “bad debt” like cars, credit cards and other personal liabilities. Prioritize building and expanding your practice the right way, and your debt will be managed in a way that allows balance with your financial plan.

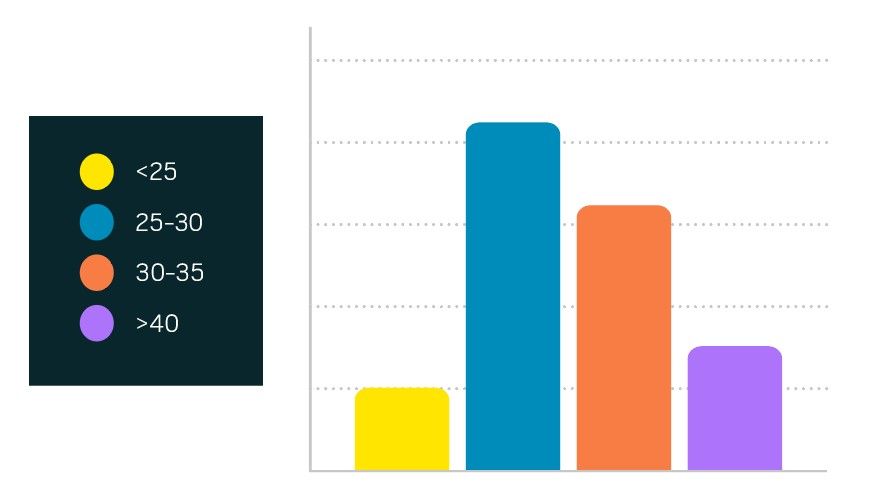

15. During what age range did you begin saving for retirement?

INCISAL EDGE SAYS: These results seem consistent with the ebbs and flows of post-college life for most professionals, with the first few years spent paying off debts and doing things like homebuying before more income is freed up for savings. Despite inflation and rising dental school tuition, these survey results feel like they could have come from the 1990s or even 2000s—an encouraging sign that dentistry still becomes sufficiently lucrative sufficiently early.

DAN WICKER SAYS: Time is the most critical factor in building wealth. Someone who saves from age 18 to 26 will accumulate more than someone saving the same amount from 27 to 65, assuming equal returns. That’s the power of compounding—and why starting early matters. Saving is a habit, and those who establish it earlier win. Your goal should be to save 20% of your income.

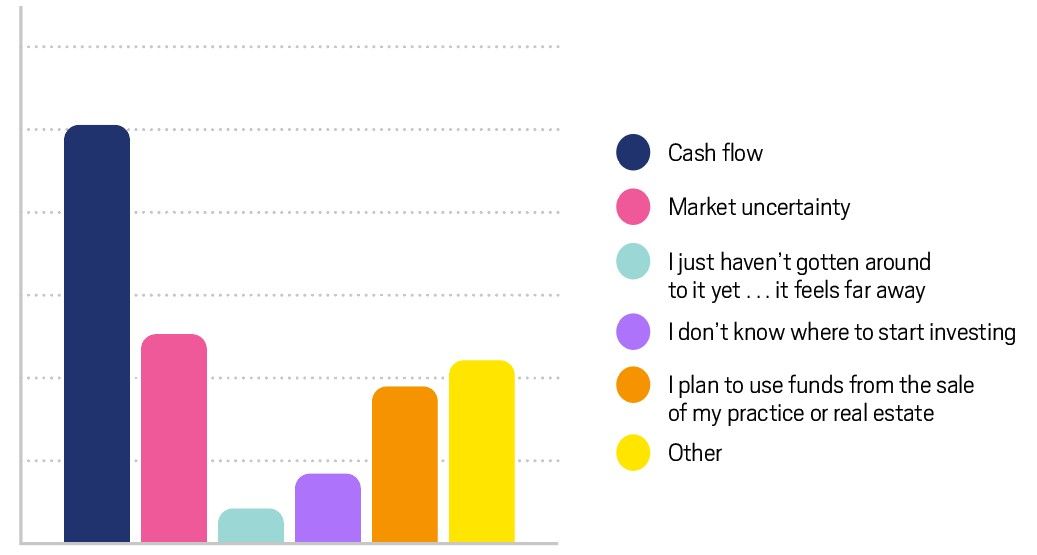

16. What factors prevent you from saving as much as you’d like?

INCISAL EDGE SAYS: Over 50% cited insufficient cash flow, but market uncertainty is a hurdle as well. Many are still counting on a practice sale to help fund their retirement, but still others are simply having trouble getting started saving. The most common theme was that investing in their practice comes first. “Much of our cash has gone into investments in business and real estate, so it’s not liquid,” said one doctor in the Southwest. “In the next two years I’ll have most of my professional debt paid off, and as those loans sunset, I’ll be able to hypercharge cash/liquid.”

DAN WICKER SAYS: Doctors must first and foremost understand their cash flow. This means reviewing production to determine if you’re producing enough to meet your cash flow needs and working to increase specific key performance indicators. Next, it’s critical to understand where the money collected is being spent, and if the levels support net profit growth. Without this insight, you cannot make the correct decisions to reach financial freedom. Emotionally, many doctors feel they simply need to earn more, but the real solution requires taking out the emotion and acting on the habit of saving. This will ultimately lead to a balanced approach for understanding your profit, and how you need to reinvest it and save for a secure financial future.

Survey Findings

Wishes, Regrets And Do-Overs

APART FROM our survey’s multiple-choice portion, responses to additional open-ended questions revealed plenty of insight. For example, if they could go back, what would our participants have done differently regarding retirement planning? Nearly half said they wish they’d started saving earlier. “Like, when I was 12. Compound interest is real,” said one Midwestern dentist. Then again, as another doctor replied, “A lack of salary impeded that a bit, lol.” Late starts, too—like beginning dental school in their thirties or embarking on dentistry as a second career—made early saving tough.

About 10% wish they’d curbed spending sooner. “My biggest advice to my younger self: Get and stay out of debt, live on less than you make and save as much as you can as early as possible,” said one Midwestern dentist aiming for a $5 million nest egg. Then again, who can blame someone for splurging after finally putting the high stress and austerity of dental school behind them?

Hiring a financial advisor earlier was another common theme, along with being more engaged. “I wish I’d inquired about the fiduciary status of advisors earlier,” said one pediatric dentist who started saving before age 25. Some wish they had invested more aggressively. “My financial planner was too cookie-cutter,” said one respondent. For those who are on the fence about retirement planning or feeling shaky about where they stand, several survey participants recommended a $10 paperback: The Millionaire Next Door. Why? “It helped me understand the psychology behind making, saving and spending money,” said a respondent from the Southwest.

After you’ve saved a little money, get a CFP with fiduciary accreditation who is fee-based and not percentage-based. Having someone to help you make decisions, set targets and help keep you on the path is so helpful, and I pay them a retainer instead of a percentage of my investments. It removes the sales aspect.”

—Dr. Chris Thorburn, Fort Worth, Texas

Different Visions Of Retirement

SOME SURVEY PARTICIPANTS described a retirement that, at best, sounds more like semi-retirement—or simply cutting back on their hours. “Travel, lecture, consulting, sipping coffee on my porch,” was one response. Another doctor envisions “working one or two days per week in practice, with passive income of $300k.” A few spoke of branching off from dentistry but still working: “Tackle some projects like possibly managing real estate,” said one. But an undeniable recurring theme was sticking with dentistry, though doing so on their own terms. “Not needing to work, but choosing to, as I love what I do,” as one respondent described it.

What would put our respondents at ease? “Eight to ten million dollars in the bank, home paid off, dental practices sold but the real estate kept,” said one mid-career doctor from a high-cost-of-living area. “Cash flow of $275k a year and being nonclinical. I may still own my practices or pursue a secondary career,” said a prosthodontist in the Southeast. Being young enough to still enjoy retirement was a popular notion, and perhaps why so many respondents still plan on working. “Forty-five years old, partially retired from dentistry” sounded ideal to one respondent, with another saying, “I want to practice two days a week. I want to travel easily. I want to still be young. I want to be doing yoga. I want to pay my staff excellent salaries.”

Plenty of respondents envision a more traditional retirement. Travel topped the wish list of 20%, followed by spending more time with family, volunteering, playing sports and focusing more on their personal wellness. “All debt paid off, living in a lake house or on the beach. Enjoying my hobbies and living close to family and friends,” said one. Another dreamed of “luxury vacations and living abroad outside the continental U.S.”

A Later Life Worth Looking Forward To

ONE TREND stood out: Worry fades with age. Younger dentists expressed more anxiety, while those 55 and older sounded more confident. “Overall, I am satisfied with what I have been able to accomplish,” said one general dentist in the Northeast. While she still has some concerns about market volatility between now and her fast-approaching target retirement age, her biggest concern isn’t money but what might happen when she reaches that life stage: “I’m worried I might get bored.”