Donald Trump is passionate about tariffs—as an end in themselves, as negotiating leverage with foreign governments and (in his view) as sound economic policy. The president’s mercurial nature aside, what effect might imposition of his preferred duties mean for dentistry at all levels, from producers to distributors to practitioners?

By Lisa Randazzo

“TARIFF MAN”—as President Trump has repeatedly styled himself—spent his first few months in office living up to the nickname, furiously threatening to impose import levies on allies and adversaries alike, revoking and then reimposing them with seemingly reckless abandon. The threat (and sometimes the reality, depending on the day and the will of the judicial branch) of stiff tariffs not just on China but on Europe, Mexico and Canada has kept business owners on edge since Trump was elected last November.

Assuming the president is able to implement at least some of what he has announced, the dental industry will be affected no less than auto companies or lumber importers. What can dentists do proactively to address it?

Any business reliant on everyday consumables as well as instruments, equipment and devices—sound like anyone you know?—will be disrupted. Dental suppliers rely heavily on the three initially targeted countries, and Europe also serves as a significant procurement source. Whether Trump follows through on his threats, reneges or something in between—at press time, he seemed to be selectively backing down, but uncertainty still reigns—lingering confusion has itself become a fraught business and political issue.

“The impact of tariffs on dentistry extends beyond just financial concerns—it influences access to care, practice sustainability and overall health care dynamics,” says Dr. Muhalab Al Sammarraie, senior dental director of AltaMed Health Services in San Diego. “The biggest concern is reduced access to care, particularly for low-income populations. Potential long-term consequences include more ER visits for preventable dental conditions, further burdening the health care system. Delayed treatment also leads to complications, affecting overall health, such as diabetes control and cardiovascular health.”

Manufacturers: The Canaries in the Coal Mine

First to feel the pain will be the companies that foot the bill to import merchandise of foreign origin for their inventory, resale or use in U.S.-based production. Some might circumvent tariffs by relocating production to a country unencumbered by them. “One way manufacturers are getting around tariffs is to send materials to Vietnam and Thailand to be assembled and shipped from there,” says Dr. David Rothman, a pediatric dentist in San Francisco and an associate clinical professor at Case Western Reserve University School of Dental Medicine in Cleveland. “And then there’s Johnson & Johnson, who’s already ahead of it with manufacturing in Puerto Rico and the Philippines.”

Another tactic of long standing is the classic Washington dark art of lobbying for exemptions. On March 4, a coalition comprising the Dental Trade Alliance (DTA), National Association of Dental Laboratories (NADL) and the American Dental Association (ADA) did just that. Initiated by the DTA and drafted by its regulatory counsel, Rick Van Arnam, the consortium sent a letter to President Trump outlining its formal opposition to the tariffs, pointing to the vast economic consequences at every link of the supply chain. The letter also called attention to the long-term effects on oral care nationwide caused by the delayed treatment that will inevitably be triggered by increased patient costs. Unsurprisingly, this is a major concern of pediatric practitioners.

“An entire generation will be affected,” Dr. Rothman says. “Children who don’t get essential oral care will suffer far into adulthood.”

Distributors: Stuck in the Middle

Once orders are filled and en route, supply chain disruptions may emerge in the form of higher

shipping costs due to rising freight prices as well as delays caused by increased customs processing time as importers adjust to new requirements. Ultimately, costs will be passed on to distributors, who in turn will pass them along to dental labs and practices.

How Tariffs Work

ALL GOODS traded between countries are subject to the Harmonized Tariff Schedule (HTS), a system run by the U.S. International Trade Commission that was enacted by Congress in January 1989. President Trump’s proposed tariffs would be added to these existing HTS tariffs and would affect products and materials otherwise covered under the United States / Mexico / Canada Agreement (USMCA, negotiated by Trump during his first term and which took effect June 1, 2020, replacing NAFTA, the North American Free Trade Agreement, enacted under President Bill Clinton).

“If and when the tariffs are imposed, the benefit of qualifying under the USMCA will go away, and all goods coming from Mexico and Canada will be subject to a 25 percent [import levy] on top of any duties they would have owed for that product under existing regulations,” says Rick Van Arnam, regulatory counsel for the Dental Trade Alliance and a partner with the international trade and customs law firm Barnes, Richardson & Colburn. “The possibility also exists that USMCA-qualifying goods will remain exempt from the additional 25 percent tariff, and only Mexican or Canadian goods that do not qualify under USMCA will be subject to the additional duties.

“Then consider China,” he adds. “Back in 2018, a set of tariffs was imposed against China by the United States under Section 301 of the Trade Act of 1974. The new tariffs would add to those, rather than replace them.”

Born in The USA

Born in The USA

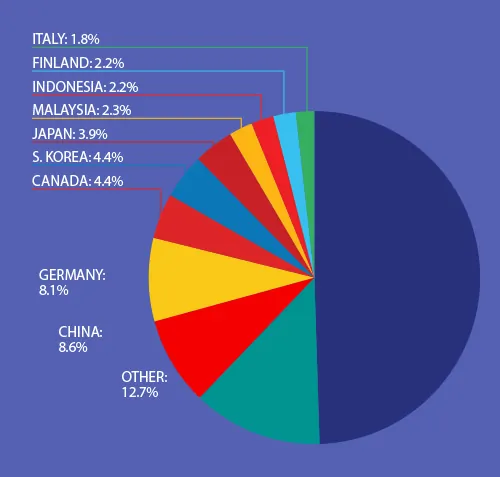

We tapped sales data from our parent, Benco Dental, to break out where most dental products it sells are made—and the results may surprise you. Despite the fact that dentists rely on a large number of parity products like gloves, the vast majority of Benco sales come from American-made items (though, as with most products today, they are often assembled from a combination of U.S.- and globally sourced components or ingredients). Meanwhile, fewer than 9 percent come from China.

“So far, we have not seen any stockpiling, but we do anticipate it may occur on select items,” says Paul Benhamou, Director of Supply Chain at Benco Dental, the parent company and publisher of Incisal Edge. “Specifically, we expect it to occur with anesthetics because it’s becoming increasingly widely known that they come from Canada. We strongly prefer that customers not panic-buy or overstock, but of course we accept that some of that will take place. We have purchased significant additional inventory in the anesthetic line. We also have the option of setting rations on select items to avoid panic-buy scenarios from wiping us out.”

Dentists: The End Users Squeezed in a Vise

While dentists strategize about how to get ahead of tariffs, their options vary depending on the size and configuration of their practice. Group practices, for example, can take advantage of economies of scale to negotiate cost reductions. “I think any dentist, if they are operating optimally and managing their bottom-line finances, are a part of some group purchasing organization [GPO],” says Dr. John Zalesky of Aurora Hills Dentistry in Aurora, Colorado, a member of the Incisal Edge 40 under 40 Class of 2024. “In a way, this levels the playing field between private practices and DSO dental offices.”

Dr. Al Sammarraie echoes Benco Dental’s Benhamou in warning doctors of the repercussions of panic buying, similar to what people everywhere experienced in grocery stores during the early months of the pandemic. “The uncertainty surrounding tariffs could lead to bulk purchasing and stockpiling, which create artificial shortages and price surges due to increased demand,” he says. “Quality will be compromised, as some may opt for cheaper alternatives.”

Options for independent private practices include locking in vendor contracts before costs rise, in addition to “frontloading” supplies with longer shelf life. “As with anything political, people have different views and will react differently,” Dr. Zalesky says. “Some people will continue to operate as usual, while others will buy and store products.”

In addition to higher-cost dental goods, Dr. Rothman points out that doctors should also keep general office supplies on their radar: “We’ve begun stockpiling our supplies that come from Europe and Asia—mainly composites—and I also plan to replace all our computers before they go up in price.” Another consideration is the possibility of delayed shipments, a problem familiar to anyone who was in business in 2020 and 2021. Experts suggest that practices review their inventory and adjust their ordering schedule to build in longer lead times.

Sentiment On the Street

Dr. John Zalesky

Dr. John Zalesky

Aurora Hills Dentistry

Aurora, Colorado

“I don’t feel the industry will be affected much. The industry is so highly profitable in all aspects, from supplies to equipment. A lot of [dental] products are made in Japan, Germany, France and Switzerland. Companies seem willing to absorb some costs based on speculation that the tariffs will be temporary. Also, companies have so much inventory already in the United States.”

Dr. David Rothman

Dr. David Rothman

Rothman Pediatric Dentistry

San Francisco

“We as a practice will experience higher costs. Insurance companies are not going to raise their payments, and staff will want more money due to the inflationary spiral that the tariffs will cause. My overhead will go up, profits will go down. Patients will have less discretionary funds, which will result in putting off dental care. In the long run, oral health will suffer.”

Dr. Muhalab Al Sammarraie

Dr. Muhalab Al Sammarraie

AltaMed Health Services

San Diego

“This issue is not just about the cost of materials—it’s about systemic accessibility. If we fail to address these challenges proactively, we may see more private practice closures, increased reliance on corporate models and widening health care disparities. The most vulnerable will be Federally Qualified Health Centers [FQHCs] and nonprofit clinics. They operate with fixed Medicaid and grant reimbursements. Unlike private practices that can adjust pricing, FQHCs cannot pass on increased costs to patients.”

For all the uncertainty, Dr. Zalesky remains optimistic about the ultimate effects on dentistry regardless of the whims of the Tariff Man in the White House. “I feel it will be of low impact. Consumers will dictate whether they put off their elective dental work other than necessity,” he says. “Some patients will put off dental work in its entirety depending on their financial situation. What I have found is that these people will eventually return and complete work. One thing is for sure: Everything will rebound at some point. It all depends on the state of the global economy.”

LISA RANDAZZO has two decades of experience in the dental industry. She is a freelance writer, editor, journalist and former executive for a prominent imaging and practice management software provider.